Biz Miles: How tracking them will save you money at tax time

Jan 03, 2022

If you use your personal car to drive for the purpose of business, you can deduct those miles! What does that mean?

Well, it essentially means that you can reduce the amount paid to Uncle Sam and keep more money in your pocket.

There are two ways to do this: the actual method or the standard method.

The actual method allows you to deduct the business use percentage of your auto expenses, which includes gas, maintenance, insurance, registration, and lease payments or depreciation (which I recommend is calculated by a tax professional).

The standard method allows you to deduct a fixed amount of cents per business mile driven. The amount per mile changes slightly each year. For 2021 it was 56 cents per mile, and for 2022 it is 58.5 cents per mile.

To keep things simple, I recommend the standard method. However, if you’re working with an accountant to file your taxes, ask them which is best for you.

So you might be saying, “okay that’s great, I will save over $1 for every business mile I claim”, however, that is not exactly how it works. The deduction is not a dollar for dollar savings. Let’s break it down.

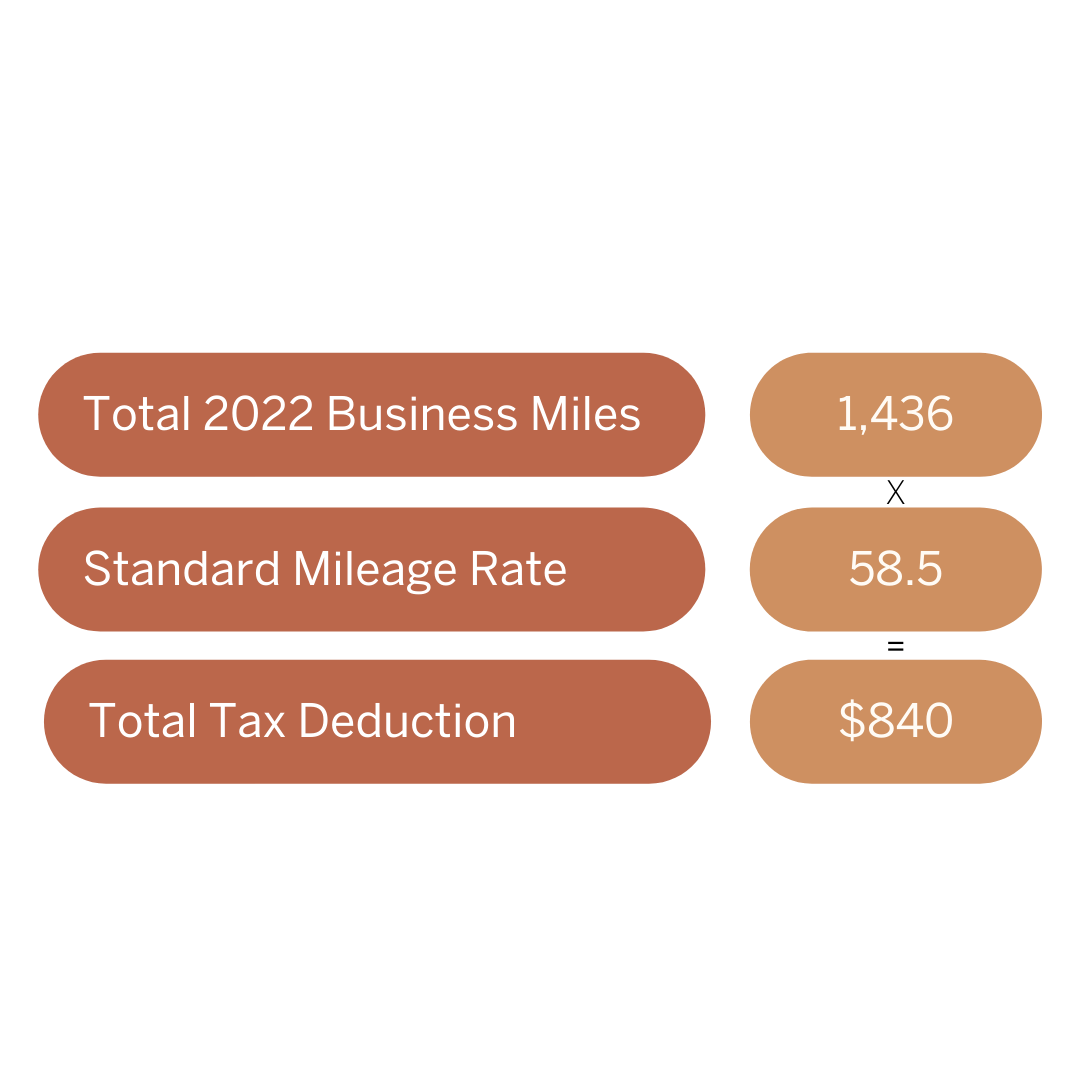

Say, for example, you drove 1,436 miles in 2022 for your business. At a rate of 58.5 cents per mile, your deduction would be $840.

Your tax deduction is $840, but that doesn’t mean you saved $840. Here is how it actually works:

In this example, you saved $252 by claiming the standard mileage deduction, which is freaking awesome!

You might be thinking, “Well I run an online business, so I don’t really drive for business”, and while that might be true the majority of the time, you likely do drive for your business at one time or another. Here are some common (and less common) examples:

- Client meetings

- Shopping for office supplies

- Post office to mail client gifts

- City/county office to apply for a business license

- Bank

- Networking events/co-working spaces

Keep track of your miles!

If you plan to use the standard mileage deduction, grab my Mileage Tracker here. This tool will help you keep track of your miles, as well as estimate what your yearly business deduction will be. PLUS I send out free updates each year, so not only will you avoid the fee you'd pay with an app, you will never have to purchase this again.

Golden Rule:

When using the standard mileage deduction, make sure you are paying for all auto expenses out of your personal account. I repeat: do not pay for your gas with your business account. The reason why is because when you claim the 57 cents or 58.5 cents per business mile, that amount includes gas, maintenance, etc. so deducting gas as well as the standard method is not allowed.

Have questions? Let me know! Want bookkeeping off your plate once and for all? Fill out the form here.

It's time to stop losing sleep over spreadsheets.

Feeling lost when it comes to all things biz finances? It’s time to take DIY bookkeeping off your plate, so you can really step into your role of CEO.