3 Ways To Allocate Profit

Oct 26, 2021

So your bookkeeping is getting done each month, whether by yourself or an outsourced bookkeeper, but now what? What should you do with the money that is left sitting in your business account each month?

There are three things you can do with your profit:

- Pay yourself

- Save for taxes

- Reinvest

I want to preface all this by saying that there is no official blueprint or rules for telling your money where to go. This guide is merely suggestions of ways you can allocate your profit, but everyone is different with varying business and life goals so this will not look the same to everyone.

If you haven’t downloaded my freebie on how to pay yourself consistently with inconsistent income, check that out!

Let’s talk through a few different ways to allocate profit based on where you are in your business.

The Side Hustler

If your business is new-ish and either not profitable yet or is bringing in just a little bit after expenses each month, you may fall under the side hustler category. You might be a full-time mom (yes, dog mom counts #goals) or have another full or part-time job that is supporting you while you grow your business.

The side hustler may have some large investments they want to make, such as a business coach, new camera body, maybe a web designer, or copywriter. They are in the building and growing stage of their business.

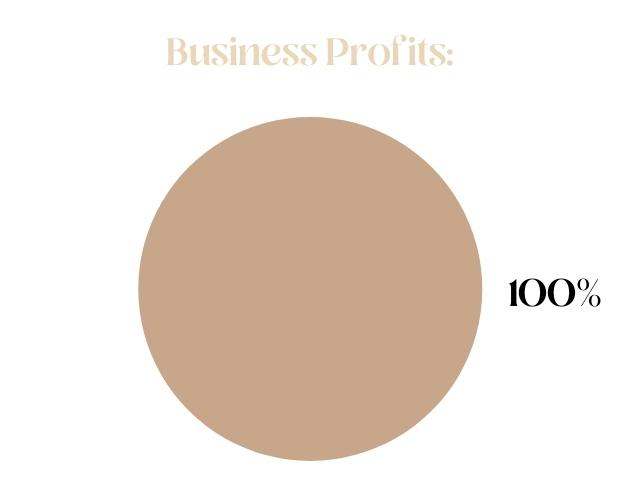

If you plan on spending any and all money you make, it's safe to say that you are reinvesting 100% of your profit. And what a cool time this is, being able to invest back into your future self and your business.

So, you might be wondering what reinvesting 100% of my profits look like? It looks like collecting money from your services into your business account and using that money to pay for business expenses. In this stage, the money likely doesn’t stay in there for long because they are going towards paying those big investments.

We talk a lot about saving for taxes. When you are in the side hustle stage and are quite literally spending any money you make, it’s less important to save for taxes because at the end of the year you are likely not going to be profitable, or profit very little.

Can you hire a bookkeeper to help you understand where you are in your biz? Totally! Yes, you can. Check out my services here.

Looking to do this yourself for now? Check out my self-paced course here.

The Expander

It can be quick moving from the side hustler to the expander. In fact, you might not even realize it if you aren’t being intentional with your biz finances.

You know you are out of the side hustle stage when you have money left over after paying for your investments.

At this stage, you can totally still have other things going on in your life, like mom duties or other jobs. Your goal in this stage is building an emergency fund. It’s a good idea to have 3-6 months of business expenses saved for when Murphey comes knocking on your door.

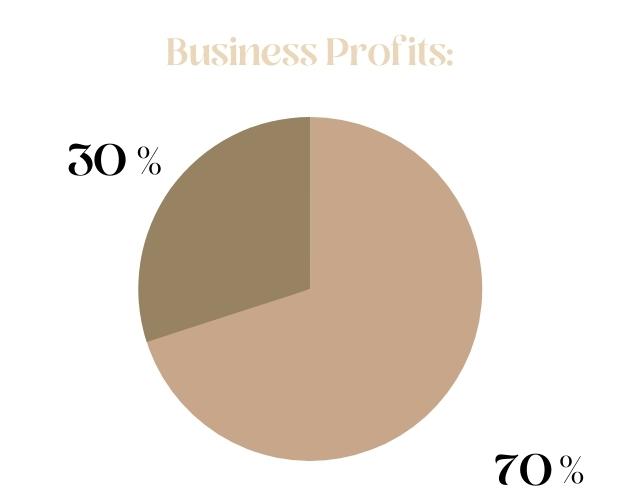

Each month after your bookkeeping is complete, review your profit and loss statement. Take your profit number, multiply it by 30%, and make a one-time transfer to a separate savings account just for taxes.

The remainder of your profit is what you have to save for that emergency fund. Similar to taxes, I recommend having a separate account for your emergency fund so you know not to touch that money unless there is an emergency.

At this point in your business you are not yet paying yourself and that is totally ok! You will get there soon and it will feel dang good when you do.

The Well Oiled Machine

After you’ve made all of your start-up investments and have an emergency fund saved, it’s time to pay yourself!

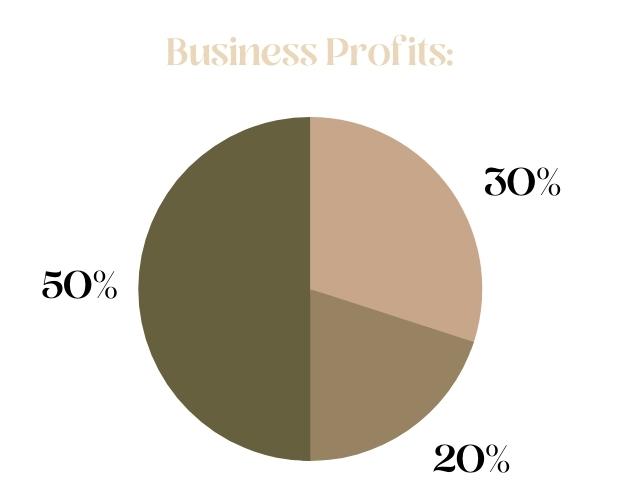

Similar to the expander stage, each month you will look at your profit and loss statement and allocate your profit how you see fit.

Once your emergency fund is saved, reinvesting can be as simple as not moving the money from your business checking account. This money will eventually be spent on future investments. If you find that 20% is a bit high and you want to change your profit allocations to pay yourself more, by all means, do it!

The key here is to be intentional with your biz finances. You’ll be surprised at what you are able to achieve.

It's time to stop losing sleep over spreadsheets.

Feeling lost when it comes to all things biz finances? It’s time to take DIY bookkeeping off your plate, so you can really step into your role of CEO.